.

| Name | ACRG (Association Costa Rica Grameen) |

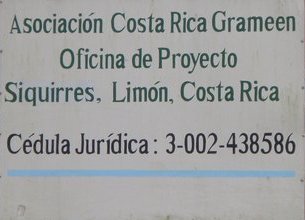

| Where | In the west of Costa Rica, in the area of Limon, Guasimo and Siquirres. |

| Type | Institution with no lucrative goal (NGO) |

| Person we met | Farid Uddin |

| Website | www.wholeplanetfoundation.org |

| Presentation on mixmarket | ICI |

| Presentation on Grameen Info | ICI |

| Amount of loans | individual loans from 100.000 CRC to 150.000 CRC (from 140 € to 210 €) for a duration from 12 to 18 months. But these loans are attributed only to a group of 5 to 9 people. |

| Number of micro-entrepreneurs | 6726 (7.100 members) |

| Interest rates | 40,65% annually, following this rule : for 100.000 CRC borrowed for 12 months or 150.000 for 18 months, the payment every 2 weeks is always 4.600 CRC (4.000 CRC for amortizing the loan and 600 CRC for interests) |

| Recovery rates | 100% in 2008 |

| Percentage of women customers | 100% |

| Comments |

The Association Costa Rica Grameen (ACRG) was found only in 2006, by the impulsion of the US based world company Whole Food Products through its Whole Planet Foundation. The first idea was to help the people employed by big banana and pineapple farms. Whole Planet Foundation missioned Muhammad Yunus's Grameen Bank for establishing an MFI on the same model as the Grameen Bank in Bangladesh. The success was fast and huge and the development now grows faster than expectations. Even if the MFI is open to men, 100% of the customers are women. ACRG prefers women because they work at home, take care of children and can continue to educate them while men often work outside of the home. For having a microloan, these women must not be relatives, and must get organized in a group of 5 to 9 people, must live not far one from each other (geographically), must have a permanent residency, be “poor”, and must have a similar mentality and financial position. 6 to 8 groups make a “center”. There are 182 centers where the groups meet each other once every 2 weeks for paying back 4.600 Colones. All the members have to pay back the same amount. A loan of 100.000 colones will be paid back in one year by 26 payments of 4.600 Colones; a loan of 150.000 Colones in 18 months by 39 payments of 4.600 Colones. Consequently, the members never go to the bank to pay back the loan, they only have to go to ACRG centers. A compulsory savings program works with all the microloans. Every 2 weeks, on top of the payment for the loan, all the members have to pay 500 Colones for savings. This money does not make any interests and is available every Tuesday. Promotion is essentially made from mouth to ears and during the meetings in the centers every 2 weeks. The system is based on trust, motivation and credibility. Thus, ACRG does not make any investigation about its members, but trust them and bet on the solidarity of the group. Even if a brief description of the microentreprise is asked, nothing is checked. Nevertheless, before according a loan, ACRG provide a short training program about accountability and methodology. The world financial crisis begins to have an impact with some people who have troubles to pay back their loan. But it does not affect the refinancing which is strong. If one of the members can not pay back his loan, the solidarity principle applies and the other members of the group have to pay for him/her. A consultation between all the members of the group is organized in order to motivate all the members, and in particular the default member. After robberies in one of the centers, ACRG have asked and now receive the help of local entities such as the Police and the Municipalities. ACRG also have the support from the Mayor of Siquirres and from the US ambassador. Any form of microentreprise is represented. |

| In the future | ACRG would like to open new branches and develop its services in all the country. |

MFI met in Siquirres on the 9th of April 2009